So, is Google toast?

Apple triggers AI panic and poleaxes GOOGL

Thank you for reading Regenerator! We’re the publication for people who want to build a better future. We analyze the biggest questions in tech, business, markets, policy, culture, and ideas.

Google investors have been fretting about the impact of AI on Google’s core search business.

Specifically, they’ve worried that — as people turn to ChatGPT, et al, for answers — Google’s search business will get disrupted.

Google has responded by weaving AI responses into its own search results: Instead of a list of sites, you now get AI summaries, thus (often) saving you a click.

But still investors fretted.

Understandably.

Because every click Google saves you is a click that can no longer generate revenue for Google — at least with its current model. And if Google’s AI answers get so good that none of us ever need to click, well, then, Google will put itself out of business.

Google, in other words, faces a classic innovator’s dilemma:

Stubbornly stick to traditional search (blue links) to try to maintain revenue and margins — and lose share to ChatGPT, et al.

Or…

Completely replace traditional search with AI summaries to keep pace with ChatGPT — and cripple their own business.

Google’s approach so far: Keep cake and eat it, too

For the last few years, Google has pursued a middle course, trying to have it both ways. And, so far, that approach has mostly worked. Search results have (arguably) gotten better and more convenient with the addition of AI answers. (I like them! And I’m not alone. See below.) And there are still enough blue links and clicks for Google search to continue to grow.

But today, Google investors — and Googlers — got a stark reminder of the AI search risk.

This reminder poleaxed Google stock, which is down 8%.

As Business Insider’s tech+media guru Peter Kafka explains, the clobbering came after mid-day testimony from Apple executive Eddy Cue in the Google antitrust trial.

Cue said two things that freaked investors out.

First, Cue said he thinks AI search will eventually replace standard search.

Second, Cue said, for the first time in 20 years, the number of searches on Apple’s Safari browser declined last month — because people are using AI instead.

Oof.

So is that it? Is Google toast?

Not necessarily.

And certainly not immediately.

For one thing, Google’s search business is still growing at an impressive rate for such a gigantic business — up 10% in Q1, to a $200 billion annual run-rate. Some folks are shifting searches to ChatGPT, et al, but most aren’t.

Second, Google does have other big businesses — YouTube, Cloud, Waymo, et al — and those aren’t threatened by AI-search replacement.

But lest this “diversification” point make you too cocky, keep in mind that Google’s search business accounts for a much higher percentage of its operating profit than it does revenue.

Specifically:

Google’s search business accounted for 56% of the company’s revenue in Q1.

And Google’s search business + YouTube + Google’s network, contributed more than 100% of the company’s operating profit.

That’s right.

Google Search + YouTube + Network generated $33 billion of operating profit in Q1. Google Cloud kicked in another $2 billion. And losses from Google’s “Other Bets” and corporate expenses reduced that total by $4 billion, so Google’s operating profit was $31 billion.

Google doesn’t disclose the exact operating profit of Search, but it has a very high margin, and YouTube and Network have lower ones. So it’s safe to assume that “Search” accounts for almost all of Google’s operating profit.

So don’t get comfy.

But also don’t panic.

Yet.

One of the best and most experienced Google analysts on Wall Street, Mark Mahaney of Evercore ISI, isn’t panicking. He thinks AI’s impact on Google search is less scary than it might seem.

Mahaney does regular proprietary surveys to assess changes in consumer behavior.

And one of his surveys focuses on exactly this question: Is the rise of AI search disrupting Google?

Based on his most recent survey (March), Mahaney makes three points that are worth keeping in mind:

First, AI search engines are increasing the number of total searches people do by enabling queries they wouldn’t have used traditional search for. With its new AI summaries, Google is seeing some lift here, too.

Second, most of Google’s revenue comes from searches with “high commercial intent” (products and services), and, so far, for these, Mahaney isn’t seeing much change in consumer behavior.

Third, people like Google’s new AI-augmented search results.

So, given that Google is trading at a P/E multiple below that of the broader market (16X), Mahaney still thinks Google’s stock is a “buy,” especially after the robust Q1 results. He has a price target of $205.

Here are some cool charts from Mahaney’s recent survey:

GenAI makes people search more:

People use GenAI more for informational searches than for those with “high commercial intent”:

Google is still the world’s go-to search brand:

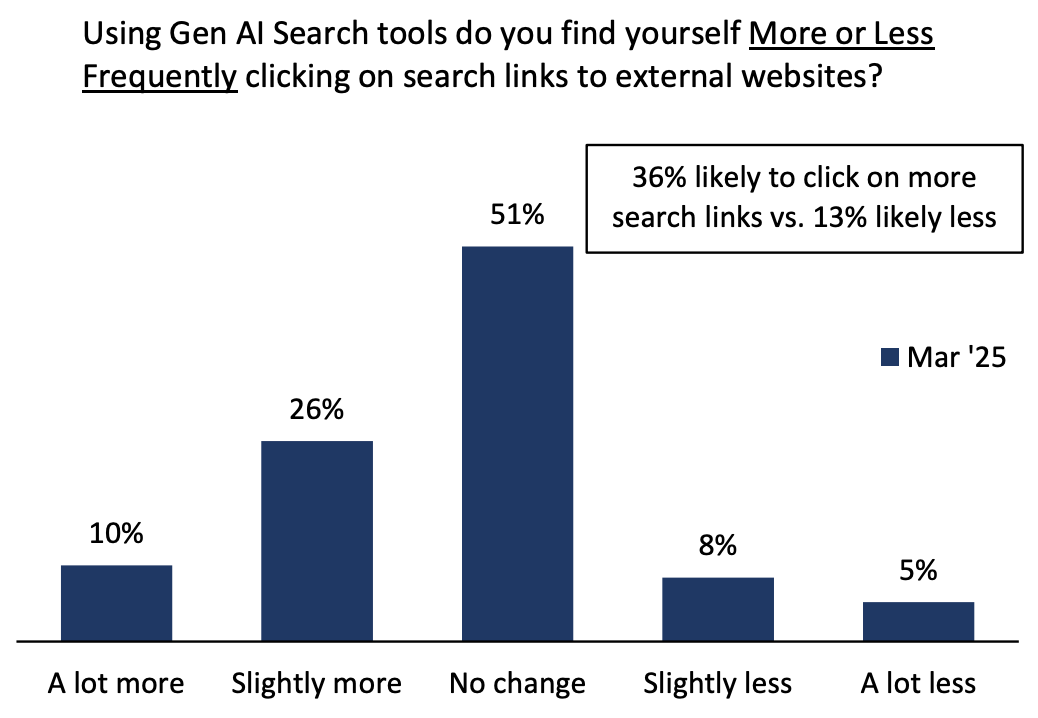

Also, interestingly — and importantly — most people say that using GenAI search either has no effect on clickthrough or makes them click through more.

And people love Google’s AI-turbocharged search results:

And what do I think?

I think the market is right to be nervous.

The survey result above notwithstanding, even if Google can retain most of its search share by weaving more AI summaries into its search results — thus retaining search share and growing queries — it’s hard to see how the number of click-throughs will continue to grow. The better the summary answer, the less need there is to click.

And even though this trend may not currently be moving the needle in searches with “high commercial intent,” it’s hard to see how it won’t eventually do that.

It’s also not obvious to me what product or business-model changes Google can make to offset this threat.

That said…

Google’s brand is still completely dominant in search, and the company may continue to find ways to add more AI without losing significant revenue (as it has so far).

Also, even if Google’s search business is, in fact, in the early stages of getting disrupted, the disruption is going to take a long time.

In the meantime, Google is going to continue to gush cash. And its other businesses will continue to grow, including YouTube, Cloud, and Waymo, which are potential monsters. And the company can likely drive higher overall margins through tighter cost control.

So, yes, the risk to Google’s core search business is real, and this is (appropriately, imho) being reflected in relatively low multiple of earnings.

But, at some level, the risk/reward for Google stock will look attractive even if you think its search business will eventually go to zero.

When I figure out what I think that level is, I’ll let you know. ;-)

Reminder and disclosure: This is not investment advice! I own Google (Alphabet) through index funds. My inbox and mind are always open. hblodget@regenerator1.com

I've held Alphabet in my portfolio a long time and don't plan to change that. I do think eventually parts of the business will spin off either because they are forced to or because it makes good sense.

People use YouTube for search but don't think of it as a search engine. We used to have “native advertising” I wouldn't be surprised if there is a way put ads in AI. I agree Waymo has huge potential. For me, the wild card is quantum. They are doing very advanced things. The path to profitability on that is long and unclear but has the potential to be incredibly powerful.