"Bubble lessons" for the AI era...

History doesn't repeat, but it rhymes!

There are striking parallels between today’s AI boom and prior tech development cycles. So here are three lessons from the last big one (the Internet):

1) Most of today’s AI companies will fail,

2) Most of today’s AI investments will lose money, and/but

3) It can be as risky to miss out as to go all-in.

The consensus is that we’re in an “AI bubble.”

In other words, a gold-rush boom that will be followed by an epic bust — and then, hopefully, world-changing long-term growth.

If so, AI is following a similar development pattern as the Internet, railroads, canals, cars, computers, and other major technologies.

To wit:

A big opportunity attracts capital, ideas, and experimentation and makes early entrants rich

The flood of capital and talent creates ever-increasing competition (supply), which, at some point, gets way ahead of demand

Experiments fail, returns tank, and the “bubble” bursts

Then, over many years, assuming the opportunity wasn’t a mass hallucination, the “right-sized” industry develops in pace with customer demand… and the scale of success and returns often exceeds even the wildest bubble dreams.

This is what happened with the Internet. It’s what happened with railroads, canals, cars, aviation, TV, et al. And it’s likely what will happen with AI.

Why does it happen this way?

Why can’t we just enjoy lucrative booms without having to deal with the pain, wreckage, and losses (money and jobs) of busts?

Because:

We don’t know what will work until we try

We don’t know when (or even if) booms will turn to busts — and it’s risky to miss out

Technology changes, but people don’t

A giant R&D lab

One thing that’s happening in AI right now is that entrepreneurs, investors, and executives are throwing money and effort at the AI opportunity to figure out what will work.

In the old days, most experiments like these were conducted in the R&D departments of big companies (Bell Labs or Xerox PARC) or by solo inventors (Thomas Edison).

Now they’re done in public, by startups, VCs, and early adopters.

This is a normal and, ultimately, productive process. It leads to a few successes… and a whole lot of failures.

Thomas Edison tried thousands of ideas and materials before he figured out how to make a lightbulb. Famously, he viewed this not as “failing,” but experimenting. Jeff Bezos has the same attitude. It worked for him, too.

These days, Edison’s experiments would be conducted by startups and funded by VC firms and forward-thinking management teams.

What seems certain is that AI is a very powerful innovation. It will have a radical impact on the future. It will transform industries and economies and produce vast companies and fortunes — just as electric lights, the Internet, and other major technologies did.

So everyone is understandably excited about it.

But…

No one knows exactly what the AI-powered future will look like.

No one knows which handful of companies will invent enduring AI lightbulbs and which thousands of others will have bad ideas, take wrong turns, execute poorly, get leapfrogged, or otherwise, as Edison put it, “successfully find 10,000 ways that will not work.”

And, on the customer side, no one really knows what to do with AI.

So we’re all throwing money and effort at the opportunity and trying to figure it out.

Lessons from the past

History doesn’t repeat… but it rhymes.

Most big tech development cycles play out similarly. AI probably will, too.

As with the Internet, AI’s impact is already extending far beyond the “tech industry.” AI infrastructure investments are so vast — at least $400 billion this year — that they are turbocharging the global economy and stock markets.

So, if the AI boom turns to bust, the shock waves will likely reverberate far beyond the tech industry.

Fortunately for the rest of the economy, there are two big differences between the Internet and AI:

Most of the AI action is happening in the private markets and being funded by rich companies and professionals. So millions of amateur speculators won’t get clobbered.

Most of the funding (so far) is coming from Big Tech cash flow rather than debt. If the infrastructure investment goes to waste, companies like Microsoft, Facebook, Google, et al, will take embarrassing write-offs — but banks and other lenders won’t blow up and drag the economy down with them.

Yes, in an AI bust, there will be plenty of pain. Stock markets and commercial real-estate will get poleaxed, colossal data-center projects will get sold for peanuts, and hundreds of startups and service providers will go bust. But, at least for now, the damage will be… contained.

Also, for now, the infrastructure build-out and startup formation show no signs of slowing. The stock prices of Nvidia, Tesla, and other “AI companies” continue to power higher. Global companies are frantically developing “AI strategies,” lest they seem like ostriches with their heads in the sand. And armchair pundits are urging executives and college grads to learn how to use the technology so they don’t get trampled by an AI “jobs apocalypse.”

Regardless of whether today’s AI boom is a “bubble,” in other words, real people have to make real decisions about how to deal with it. And the sums being wagered — on capex, products, and equity investments — dwarf anything in the early years of the Internet.

So, assuming past is prologue, here are three lessons from the Internet era:

Almost all of today’s AI experiments (companies) will likely fail

Almost all capital invested in today’s AI experiments will likely be lost, and/but

It can be as risky to miss out as to go all-in

1) Almost all of today’s AI experiments will likely fail

I was a stock analyst during the Internet bubble.

I got some things right and some things wrong.

What I got right:

The Internet was a profound technology that would disrupt the global economy and create (and destroy) vast companies and fortunes.

The Internet craze in the late-90s stock market was a bubble.

Most early Internet companies would die and/or never regain their bubble highs.

What I got wrong:

I missed the top. (Duh. You’re going to be too early or too late — so pick your poison. I would respectfully suggest that it’s less-bad to be too early.)

The crash was so devastating that even the best companies got crushed

The number of early leaders that thrived over the long term (out of hundreds of early public Internet companies) would be counted on one hand

So, even if AI turns out to be a profound, world-changing technology, don’t be surprised if there are colossal setbacks.

And don’t be surprised if most of today’s early AI leaders — Nvidia, OpenAI, Anthropic, Perplexity, Mistral, DeepSeek, CoreWeave, and others — stumble and fall.

2) Almost all capital invested in today’s AI experiments will likely be lost.

Remember:

Much of what’s happening in AI is still “R&D,” and most R&D experiments fail

Early infrastructure investments in prior booms — such as fiber-optic cables and railroad tracks — did end up getting used, but most early investors who funded them lost their shirts

Even industry leaders can get leapfrogged fast

In the early years of Internet search, for example, it seemed like Yahoo was poised for generational dominance. Yahoo’s execution blew away that of Excite, Lycos, Infoseek, and other early search engines. For five years, Yahoo left the rest of the industry in the dust.

Then a little company called Google came along and nuked it.

Similarly, today’s LLM giants may get leapfrogged by future entrants. These companies require vast capital and energy to operate. Their rate of improvement relative to the required investments is slowing. And no matter how much “compute” the companies use, the next big leap always seems a year or two away.

It will not be a surprise, therefore, if nimbler startups with new architectures or approaches blow today’s leaders up.

So, how do you make smart investment decisions?

In the Internet bubble, the biggest returns went to those who:

got in and cashed out early (before the bubble burst), and/or

bought in after valuations collapsed, and/or

picked a long-term winner like Amazon and held on for decades

So, if you’re investing in AI these days — securities or capex or projects — remember that almost no trees grow to the sky. And don’t bet more than you can afford to lose!

3) It can be as risky to miss out as it is to go all-in

Before a bubble bursts, it’s a boom.

Booms create (and destroy) companies and fortunes and make or break careers.

Booms can also last for years.

So if your plan is to just sit out the current AI craziness, you might want to consider the other kind of risk you’re taking — the risk of missing out while everyone else races ahead.

Barnes & Noble, Walmart, and other massive retailers that initially pooh-poohed the Internet never caught up with Amazon. Executives who dismissed e-commerce and other Internet trends as “fads” were soon relieved of command. Investors who declared Internet stocks “too expensive” underperformed for years.

Predictions are hard, especially about the future.

And everything’s obvious in hindsight.

Years or decades from now, when we know how AI plays out, it will be screamingly obvious whether/when everyone should have hit “sell” or cut AI investments to zero.

Alas, now, it’s not so clear.

Even if you’re sure that what’s happening is a bubble, you can lose your shirt (or career or company) long before events prove you “right.”

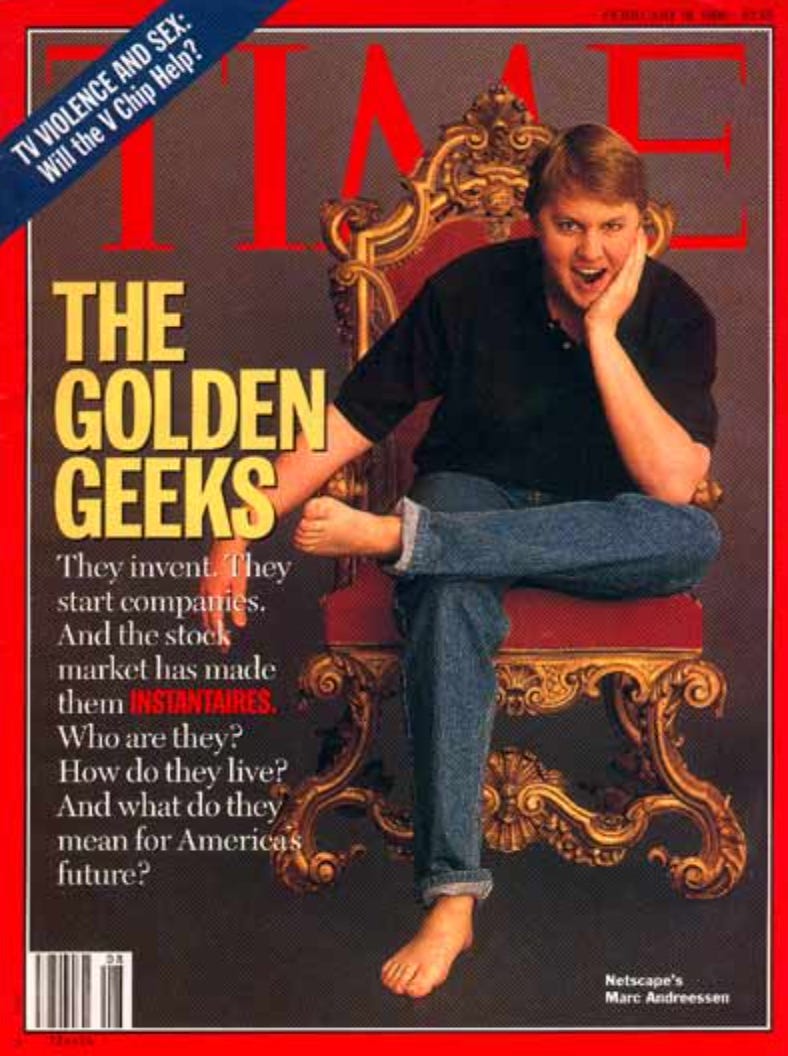

In the Internet era, cries of “bubble!” and doom-predictions began in 1995, with the Netscape IPO. Every year thereafter, smart people warned about imminent disaster — only to be humiliated (and, often, fired) for being disastrously wrong.

In our hyper-competitive economy, timing matters. Performance is measured in months and quarters. Multi-year time periods might as well be eternity. So you can get fired long before you end up being “right.”

The Internet boom claimed the scalps of not only legendary investors but executives who missed it. It destroyed the value of hundreds of giant companies, vaporizing careers, jobs, and investments.

The AI boom will do the same. Which is why investors and executives are frantically trying to figure out how to play AI before they get left behind.

In other words, even for those who think today’s AI is wildly overhyped, the big questions are…

Where are we in the AI “bubble” phase?

Are we years before the bust? Or months?

Is it 1996 or 1999?

If I had to guess, I’d say we’re in about 1997 — a few years before the bust. I would also respectfully suggest that no one knows for sure, and there’s no way for anyone to know for sure.

And that makes today’s decision-making especially difficult. Because it can be as risky to miss out on booms as it can be to go all-in.

Thank you for reading Regenerator! More on this topic soon. Next, for example, I’ll address a question that should be top of mind for anyone investing in, doing business with, or building products or strategies around the LLM industry leaders…

I enjoyed this primer on internet booms and busts. I need to be reminded of these facts. There were many, many things in this article I had not considered. I learned a great deal. Will I repeat some of the errors I have made in the past? Probably. Thank you, Mr. Blodget.